Empowering financial inclusion in Rwanda

Enterprise

Kayko

Presentation of the enterprise

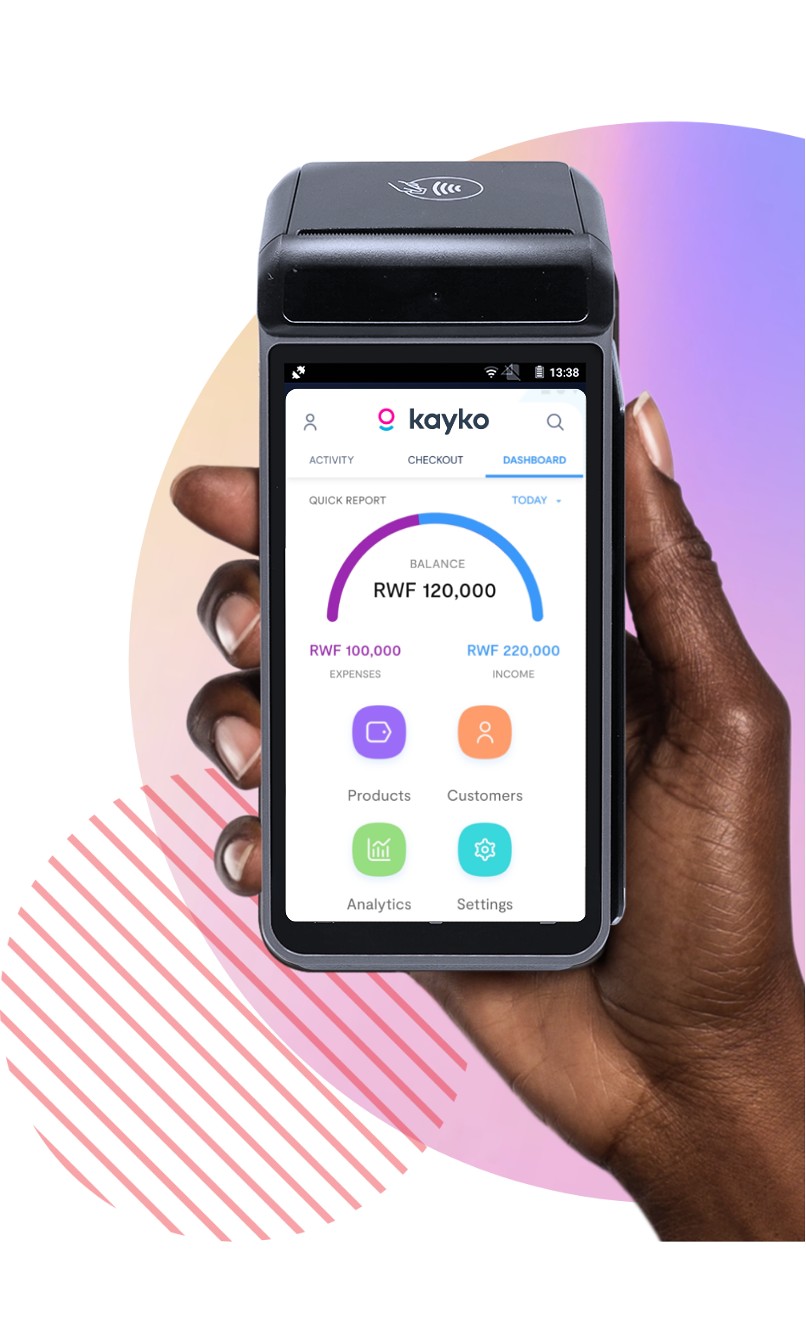

Founded in 2020, Kayko provides digital bookkeeping and financial tools for small businesses in Rwanda.

Amount of co-financing

EUR 350,000

- Rwanda

- 2025

- Ongoing

Challenge

Rwanda’s economy is thriving, with over 500,000 SMEs employing 93% of the workforce and contributing 55% of GDP. Yet their growth is held back by limited access to affordable financial services. At the same time, around 6 million of the country’s 14 million people remain underserved by financial institutions, especially in rural areas. High transaction costs, restricted access to credit, and low digital adoption for part of the population —linked in part to digital illiteracy—make financial inclusion a major challenge.

Innovative solution

Kayko has developed a financial inclusion platform that makes transactions simpler and more affordable. It offers a smartphone-independent debit card for individuals, cost-effective Point of Sale (POS) terminals, and integrated management tools for SMEs, including inventory, payroll, and tax compliance solutions.

Impact

- 2,350 new SMEs using Kayko’s services (POS and digital business management tools), almost doubling the total number of SMEs covered

- Nearly 30,000 more indivduals accessing Kayko’s services

- 500 agents trained to operate within the Kayko Pay network, generating income through this activity

Photo credit ©Kayko

Targeted Sustainable Development Goals

-

2,350 new SMEs use Kayko’s services (POS and digital business management tools), almost doubling the total number of SMEs covered. 500 agents get a revenue from their activity within Kayko Pay network.

-

Nearly 30,000 individuals’ access Kayko’s affordable financial services.

News

-

LuxAid Demonstration Fund

Dec. 2025

Dec. 2025Over 1 million euros to supports high-impact business innovations in Kosovo

After the success of the first edition in 2025, the Luxembourg Development Cooperation is launching a new call for proposals aimed at well-established Kosovo-based businesses. The LuxAid Demonstration Fund (LDF) seeks to accelerate the growth and impact of digital and green innovative solutions. Selected projects will receive up to EUR… -

LuxAid Demonstration Fund

Dec. 2025

Dec. 2025Driving Change in Kosovo: How businesses are tackling city congestion and industrial waste

What if the greatest challenges to Kosovo’s future weren’t a shortage of ideas, but the struggle to turn them into reality? Across the country, a new wave of companies is turning real-world problems into scalable products – from easing urban congestion to cutting industrial waste. Among the initiatives supporting this… -

LuxAid Challenge Fund

Nov. 2025

Nov. 2025How businesses from Kosovo are transforming education and manufacturing

In late 2024, Luxembourg’s Development Cooperation launched a new call for proposals under the LuxAid Challenge Fund, a programme designed to support innovative, locally driven solutions to social and economic challenges. Competition was intense: more than 80 applications poured in from across Kosovo, each with bold ideas to tackle the… -

Business Partnership Facility

Sep. 2025

Sep. 2025The BPF, a driver of sustainable business

The Luxembourg State supports the creation of innovative partnerships, inviting the private sector to invest in developing countries. Through the Business Partnership Facility (BPF), Luxembourgish or European companies join forces with foreign partners to generate positive societal impact. Discover in Paperjam the story of e-LMA and Swiss Premium, a win-win… -

Business Partnership Facility

Sep. 2025

Sep. 2025From Luxembourg to Kosovo: Building the finance of tomorrow

Read the interview of Jabir Chakib (CEO of e-LMA) and Ilir Ibrahimi (CEO of Swiss Premium) to have their insight on this BPF-backed project in Kosovo. -

Business Partnership Facility

Sep. 2025

Sep. 2025Launch of the 14th edition of the BPF: Boost your impactful projects in developing countries

Business growth and positive impact? Yes, it’s possible! Whatever your sector, the Business Partnership Facility (BPF) can help your enterprise expand internationally while contributing to a fairer, more inclusive and sustainable future. -

LuxAid Challenge Fund LuxAid Demonstration Fund

Nov. 2025

Nov. 2025Eight bold innovations shaping Kosovo’s future

After months of mobilisation across a vibrant ecosystem and a rigorous selection process, eight groundbreaking projects led by Kosovo-based enterprises have been awarded support through the Luxembourg Challenge Fund (LCF) and the Luxembourg Demonstration Fund (LDF). Launched in late 2024 with a budget of more than EUR 1.5 million, this… -

LuxAid Challenge Fund

Apr. 2025

Apr. 2025LuxAid Challenge Fund: 15 innovative entrepreneurs pitched their projects in Benin

The LuxAid Challenge Fund in Benin has reached a major milestone with the recent Pitch Days held in Cotonou…